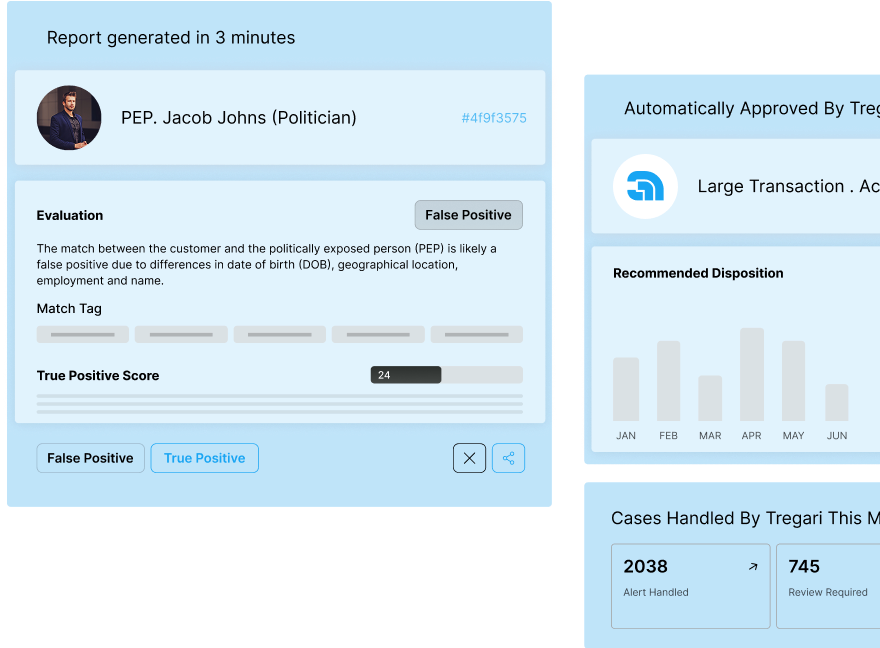

Global financial institutions trust Tregari ai to automate up to 95% of AML, Sanction and KYC reviews, allowing them to scale compliance while reducing costs.

Trusted by banks and platforms under OCC, FDIC, and SEC oversight

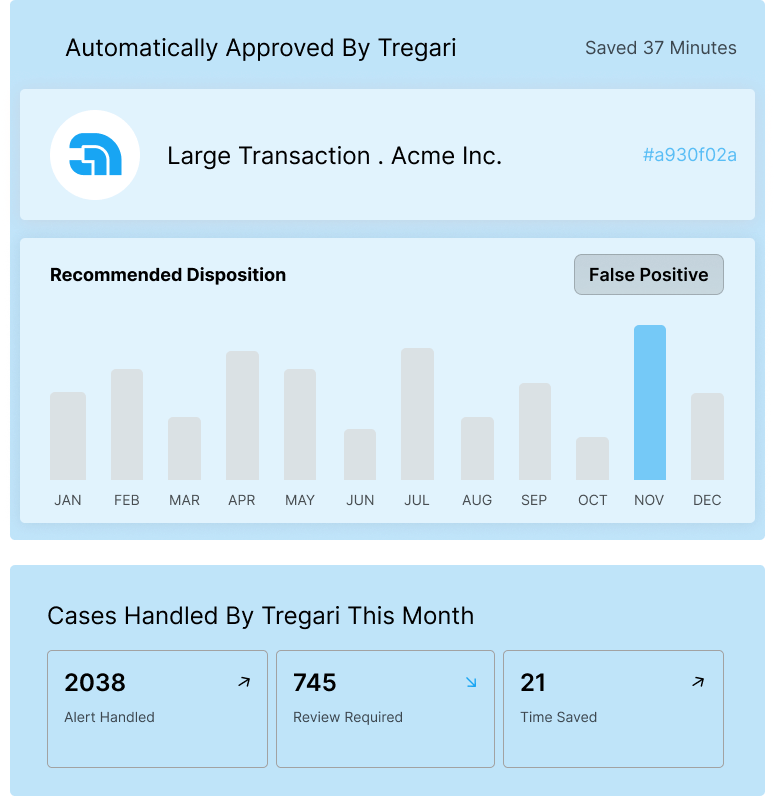

Automation scales compliance allowing you to optimize and streamline onboarding without additional hiring.

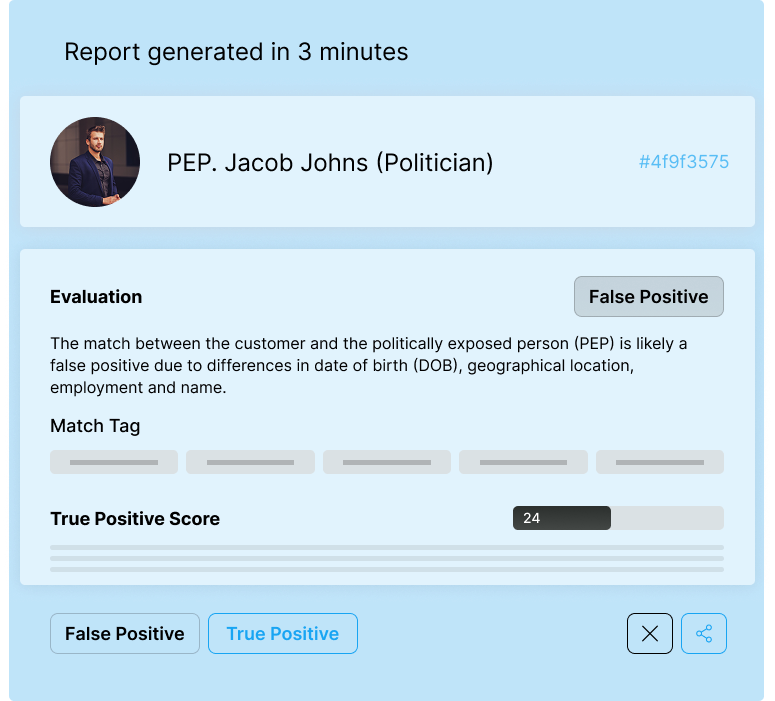

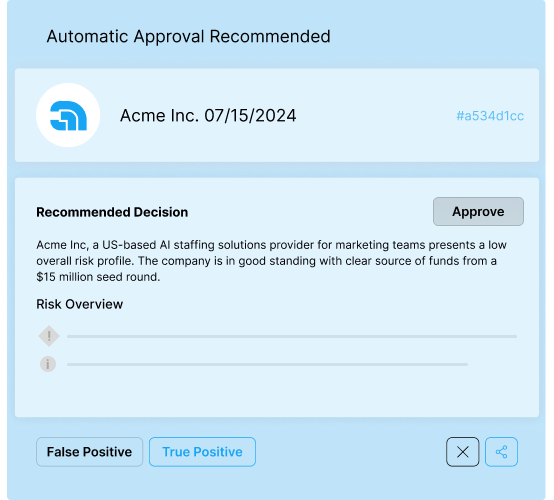

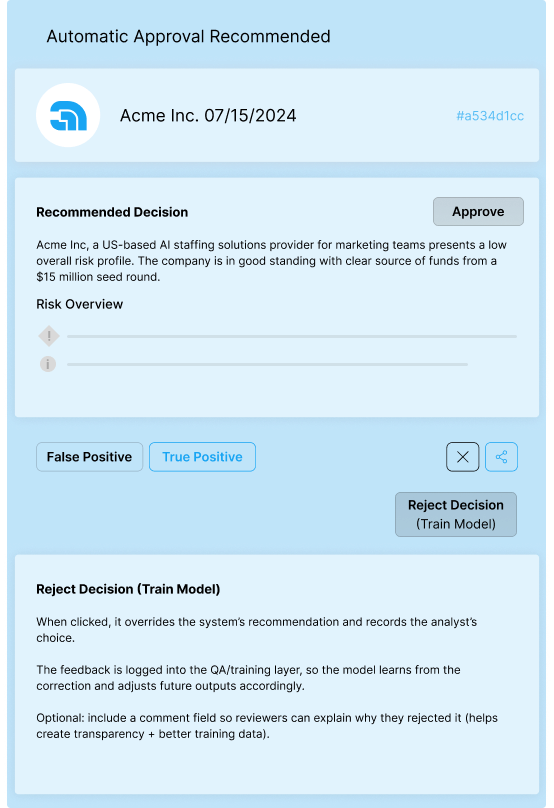

Tregari gives you full end to end transparency and control. We avoid the blackbox so you can define the decision rules.

Gain full control as the learning model adapts to your risk policies and SOPs, delivering decisions with a transparent, auditable trail.

scale compliance with fewer resources.

fast, auditable compliance automation.

manage alert volumes in real-time.

affordable, regulator-ready compliance tech.

“Tregari.ai is a model for how financial institutions can better protect the financial system by using tools that are better and less expensive than just hiring more people."

Former CEO of Fannie Mae

Greenlite Agents handle work inside of your existing AML and compliance systems, helping you unlock the benefits of generative AI without having to “rip and replace” what’s already working.

Greenlite Agents work seamlessly with popular case management and screening tools.

Agents learn from your existing risk policies and procedures, helping you automate work in a consistent and auditable way.

By automating repetitive case work, Agents allow human reviewers to focus on complex cases and risk based decision making.

Agents provide built-in QA checks on every decision, ensuring accuracy, consistency, and regulatory alignment. This reduces human error and gives compliance teams full confidence in automated outputs.

Agents adapt to your Customer Risk Assessment (CRA) framework, automatically monitoring clients against risk triggers. When thresholds are met, they initiate CDD/EDD reviews and generate structured reports to support compliance teams.

Every Agent now has U.S federal banking regulatory guidance embedded into their DNA, ensuring the highest level of adherence to model validation standards.

Get in touch to understand how Greenlite can help your team move faster with better compliance.

Tregari.ai is an AI SaaS company based in the UAE, founded to solve the most pressing compliance challenge: the burden of sanctions and PEP alert reviews. Our mission is to deliver secure, explainable, and auditable AI for financial crime compliance.

Go-to-market, commercial, and sales lead.

Head of Product Development

Technical development & engineering.